Unlock Financial Adaptability With an Online Payday Advance for Immediate Cash Requirements

In a hectic world where monetary emergencies can arise suddenly, having access to prompt cash money can provide a complacency and peace of mind. On-line payday advance loan have ended up being a prominent choice for people looking for quick remedies to their temporary financial demands. With the comfort of applying from the convenience of your home and quick approval procedures, these financings provide a way to bridge the space in between paychecks. Nonetheless, there are necessary factors to take into consideration before opting for this economic device. Understanding the advantages, qualification requirements, repayment terms, and accountable loaning methods can help individuals make notified choices concerning their financial versatility.

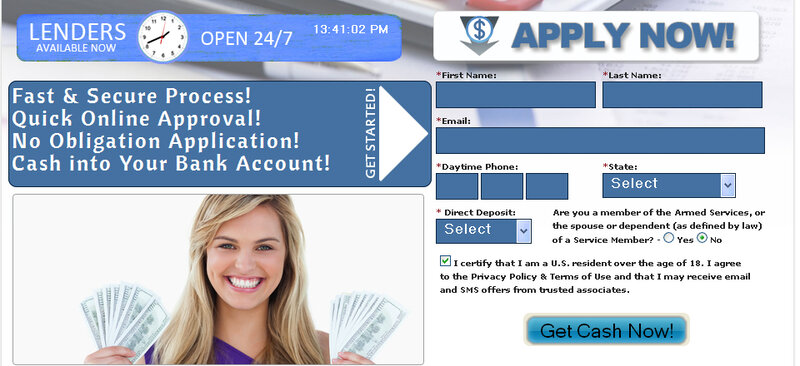

Benefits of Online Payday Loans

Online payday advance supply a speedy and convenient option for individuals facing prompt financial obstacles. One of the key advantages of on-line payday car loans is the speed at which funds can be accessed. Unlike traditional financings that might take days and even weeks to process, online payday advance typically give authorization within hours, with the cash deposited straight right into the borrower's checking account. This quick turnaround time makes on-line payday advance loan an attractive choice for those in urgent requirement of funds.

Another advantage of on-line payday advance loan is their ease of access. Lots of online lending institutions operate 24/7, enabling customers to obtain a funding any time of the day. This versatility is specifically valuable for individuals with busy schedules or those who call for funds outside of standard financial hours.

Furthermore, online payday advance commonly have marginal qualification requirements, making them obtainable to a vast array of debtors - payday loans near me. While typical loan providers might call for an excellent credit history or security, online payday lending institutions often prioritize a customer's revenue and capacity to repay the lending. This more comprehensive approach allows people with differing economic histories to obtain the funds they require in times of crisis

Qualification Needs for Authorization

Meeting the eligibility needs for approval of a cash advance funding is contingent upon different variables that assess the candidate's financial security and capability to repay the borrowed amount. To qualify for an on the internet cash advance lending, applicants generally require to satisfy particular requirements set by the lender.

Furthermore, candidates may be required to give proof of identity, such as a government-issued ID, and proof of revenue, such as pay stubs or financial institution statements. Satisfying these qualification needs is vital for the authorization of a payday funding, as they assist loan providers examine the applicant's capacity to pay off the lending on schedule. By guaranteeing that these needs are satisfied, candidates can raise their opportunities of being approved for an online cash advance to meet their immediate cash demands.

Fast Application and Approval Process

Efficiency is paramount in the application and authorization procedure of getting an on-line payday advance for instant cash needs. When encountering immediate economic situations, a rapid application and authorization process can make all the difference. On-line payday advance loan suppliers recognize the urgency of the scenario and have structured their procedures to guarantee quick accessibility to funds for those in requirement.

To start the application procedure, debtors typically fill in an easy on the internet type that requires fundamental individual and monetary info. This form is developed to be easy to use and can normally be finished in a matter of minutes. Once the type is submitted, lenders swiftly evaluate the find out details offered to identify eligibility and examine the car loan amount that can be offered.

Payment Options and Terms

When considering an on-line payday advance for immediate cash money requirements, recognizing the payment options and terms is essential for debtors to manage their economic responsibilities properly. Typically, cash advance lendings are temporary financings that debtors have to pay off on their next cash advance. Nevertheless, some lenders offer even more adaptability by permitting consumers to extend the repayment period or decide for installment settlements.

Repayment terms for on the internet payday advance differ among lenders, so it's important for borrowers to meticulously evaluate and understand the details terms outlined in the funding arrangement. The repayment quantity generally includes the principal lending amount plus any kind of suitable charges or passion charges. Customers should be mindful of the due day and the complete amount they are expected to repay to prevent any possible late fees or penalties.

Additionally, some lenders might offer choices for very early repayment without sustaining added fees, permitting borrowers to reduce rate of interest prices by paying off the car loan quicker. Recognizing and sticking to the settlement choices and regards to an online cash advance can help consumers successfully manage their financial resources and avoid falling into a cycle of financial obligation.

Tips for Accountable Loaning

Additionally, customers should completely check out and recognize the terms of the loan, consisting of the repayment routine, find this rates of interest, and any kind of added fees included. It is vital to borrow from credible loan providers who are transparent about their financing methods and supply clear details about the complete expense of loaning.

To stop falling under a cycle of financial obligation, borrowers need to stay clear of obtaining several payday advance at the same time and avoid making use of payday advance for long-lasting financial issues. Accountable borrowing requires making use of cash advances as a short-term option for immediate monetary demands, as opposed to as a routine resource of funding. By practicing prudent borrowing behaviors, individuals can effectively handle their funds and avoid unneeded financial debt.

Conclusion

Finally, on-line cash advance offer a convenient option for people dealing with instant money requirements. With quick application and approval procedures, flexible repayment choices, and marginal qualification demands, these car loans offer monetary adaptability for customers. It is necessary to obtain sensibly and just take out a car loan if definitely needed to avoid falling under a cycle of financial obligation.

Unlike standard lendings that may take days or even weeks to process, on the internet cash advance lendings typically offer authorization within hours, with the cash deposited directly into the borrower's bank account. Fulfilling these qualification needs is important for the moved here approval of a cash advance financing, as they help lending institutions examine the applicant's capacity to pay off the funding on time (Easy to find a Fast Online Payday Loan). Normally, cash advance finances are temporary lendings that debtors should pay off on their next payday.Payment terms for on the internet cash advance finances differ among loan providers, so it's vital for borrowers to very carefully assess and comprehend the certain terms detailed in the funding contract.To protect against dropping right into a cycle of debt, debtors need to stay clear of taking out multiple cash advance loans concurrently and refrain from making use of payday financings for long-lasting financial concerns

Comments on “Situating Cash Advance Providers in Your City”